LEADING EKYC SOLUTION PROVIDER IN BANGLADESH

EKYC is a process by which the financial institutions and NBFIs screen their customers during onboarding. In doing so, financial institutions and NBFIs follow the local laws and regulation, and international best practices. They collect customers' identity related information and verify those with authorized government agencies.

eKYC FEATURES

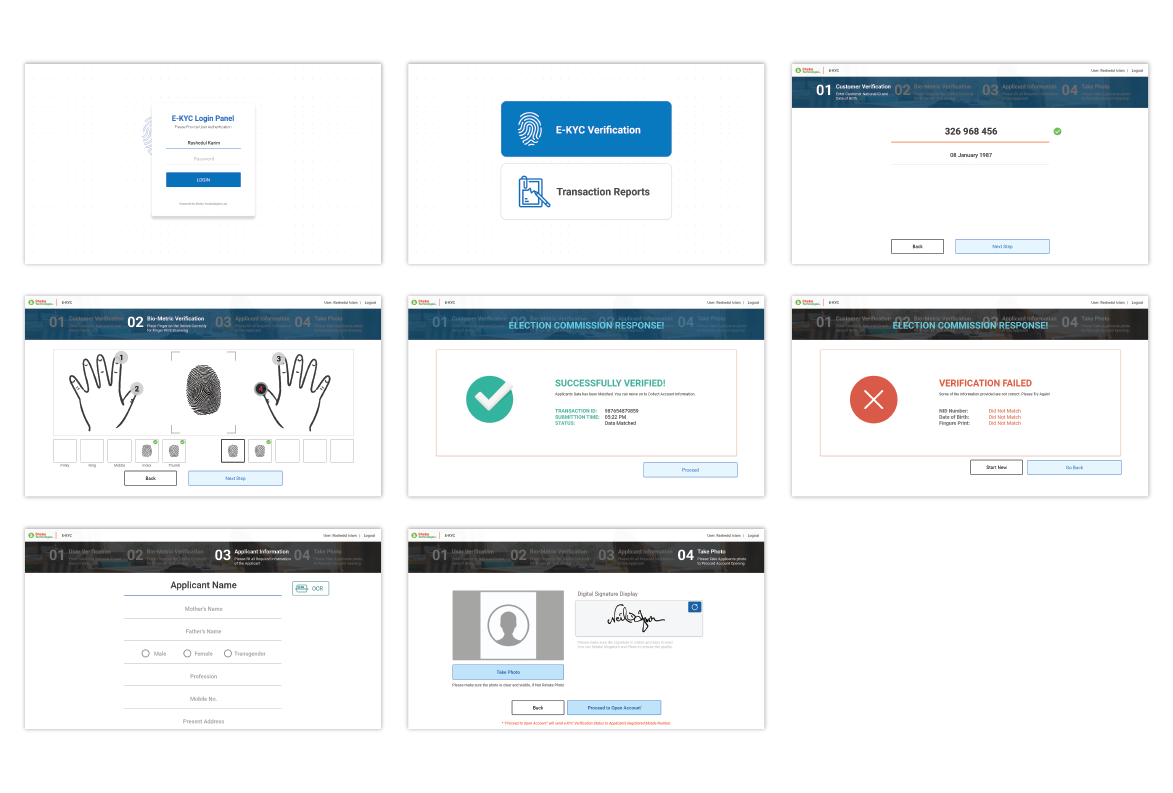

Fingerprint Verification

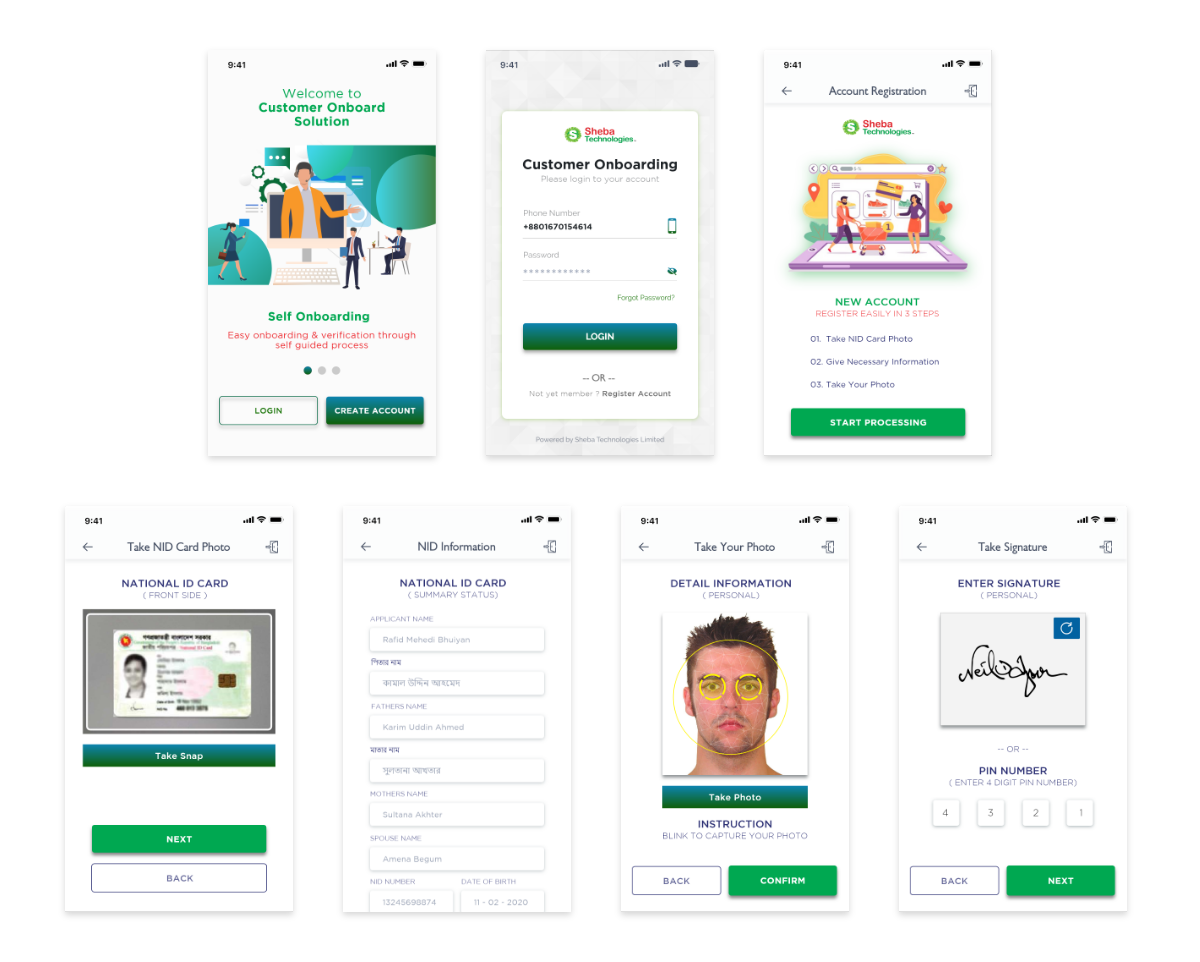

Face Verification

Sanction & Screening

Customer Risk Grading

Customer Profiling

Digital Record Keeping

CBS & AML - Integration

SMS & E-Mail Integration

Home-grown Software

Banking Grade Security

BFIU Guideline Compliant

24/7 Support Team

EXPERIENCE in eKYC

Sheba Technolgies Ltd. successfully completed the 1st EKYC pilot for United Commercial Bank (UCB) in October 2019 initiative by Bangladesh Financial Intelligence Unit (BFIU), Bangladesh Bank with 10 Financial Institutions (Bank/NBFI). Additionally, we have a customer base of 120 Million Nationwide, who has been successfully verified by our system.

Simplified e-KYC via Face Verification

Regular e-KYC via Fingerprint Verification